Capital Structure on Valuation by Guillermo L Dumrauf :: SSRN

Content

But the market value of equity stems from the real, per-share prices paid in the market as of the most recent trading date of a company’s equity. If a company consistently performs well from a profitability standpoint and decides to reinvest into its current growth, the retained earnings balance will increasingly accumulate over time. Attributing preferred shares to one or the other is partially a subjective decision but will also take into account the specific features of the preferred shares. An asset’s initial book value is its actual cash value or its acquisition cost.

- Accountants do for capital leases what we suggested that they need to do for operating leases.

- Do note that the book value of debt does not account for the amount of interest that the debts carry.

- The book value of equity is a measure of historical value, whereas the market value reflects the prices that investors are currently willing to pay.

- The profitability module also shows relationships between Platinum Group’s most relevant fundamental drivers.

- Paypal is a company that doesn’t use a lot of debt to finance its growth because it generates tremendous cash flows and can finance its operations with those cash flows.

Comparing BVPS to the market price of a stock is known as the market-to-book ratio, or the price-to-book ratio. Fourth, you are valuing the business for a buy or sell valuation decision and so it should reflect today’s prices rather than prices paid. First, book value is arrived at using financial accounting principles and related regulations. You use the market value of debt and equity to compute the weights of debt and equity in estimating WACC. If you don’t do this, your portfolio allocation will be skewed against your target asset allocation. Platinum Group is currently under evaluation in book value per share category among related companies.

Example of Book Value of Debt

Leases Commitments converted into debt (by discounting at a pre-tax cost of debt) and shown on balance sheet. Accountants do for capital leases what we suggested that they need to do for operating leases. One cost of having them do it is that you do not control when the present value is computed and the pre-tax cost of debt used. Measures the taxes you will have to pay on additional income that you will generate on new investments and the savings that you will obtain from a tax deduction.

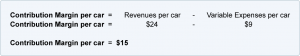

Looking only at that sales number before investing would be a mistake. You find out that they paid $100,000 in non-production salaries, another $200,000 in production expenses and currently owe $200,000 in long-term liabilities. When you subtract the $300,000 in salaries and production expenses from the $500,000 in sales, you are left with a $200,000 profit. With that $200,000 in long-term liabilities, the company is barely breaking even and any loss in revenue this year or next could mean a losing investment. If a similar company with only $50,000 in long term liabilities came along looking for an investor, they would have a broader profit margin, higher assets and be a safer investment bet.

market value of debt vs book value of debt: What’s the Difference?

Carrying value or book value is the value of an asset according to the figures shown in a company’s balance sheet. From Year 1 to Year 3, the ending balance of the common stock and APIC account book value of debt has grown from $200mm to $220mm. From the opposite perspective, the less promising the future growth and profit opportunities seem, the more the book and market value of equity will converge.

What is book value of debt on balance sheet?

Book value of the debt refers to the value of Notes payable amount, long-term debt, and the current portion of the long-term debt as per the balance sheet of the company.

Recent Comments