Net 30 and Other Invoice Payment Terms

Content

- Why do clients prefer net 30 accounts?

- How to Get a Business Loan With Bank of America

- Applying for Vendor Accounts

- How Does a Net 30 Payment Term Work?

- Factoring may be your ideal alternative to offering net 30 terms.

- What is “Net 30,” & What Does it Mean on an Invoice?

- Business Credit Cards: Another Easy Way to Build Business Credit

For example, a business can use the term “Net 30” to show that a customer must pay within 30 days from the date the invoice was sent. “Net 30” is a shorthand term used on invoices to indicate that a customer has 30 days to pay. This simple concept connects to other areas of business operations, including customer communication and accounting. Net 30 payment terms are among the most common invoice payment terms, but whether they’re ideal for you depends on your business, goals, and other factors. On this page, you’ll learn what net 30 terms are, get an overview of similar terms, and explore alternatives.

Not only will trade credit help you to stretch your cash flow, it can also help you to establish business credit, even if your company is a startup or new to credit. In fact, the Small Business Administration recommends vendor accounts as one of the top ways for businesses https://www.bookstime.com/articles/days-payable-outstanding to build credit for the first time. Maintaining a good relationship with your vendors can build trust and provide you with products and information that can help your business grow. In some cases, staying on top of your vendor and supplier invoices can also save you money.

Why do clients prefer net 30 accounts?

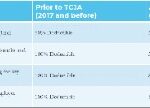

The buyer has 90 days (3 months) to submit payment to the seller, interest-free. This is for larger businesses that have many different revenue sources to offset delayed payment by its clients. The buyer has 30 days to pay (often from the date the goods or services were delivered, or the date of the invoice), interest-free. The standard credit extension used by most small businesses and freelancers, which is a strong incentive for the buyer to use the particular supplier in the first place. The advantages of COD purchases are great for consumers with credit cards, as they minimize the risk posed by scammers online. With the payment only required when the client can actually inspect the goods, the customer can decide to pay or not pay.

However, it’s never more important to know what your credit looks like than when you’re getting ready to apply for financing. While many vendors are willing to open net-30 for startups and other business credit newbies, some may still want to review your credit reports first. The last thing you want to experience when you apply for financing is an unpleasant surprise hanging out on your credit report without your knowledge.Thankfully, accessing your credit is easy. You can check your business and personal credit side by side with Nav. In a perfect world, the customer would then always pay the invoice within that 30 day period.

How to Get a Business Loan With Bank of America

In this way, the client gets to inspect the goods before submitting payment, and the supplier receives payment or the goods are returned. This is a type of transaction where the customer has to provide payment when the goods are delivered. If no payment is made, then the goods are returned to the seller. The supplier gets to have its invoice paid much more quickly, which is very good for its cash flow. The client has the advantage of being offered a lower price for the same product or service.

- Net 30 means that the buyer has 30 calendar days after they’ve been billed to remit payment.

- That’s why it can be more challenging for a new business to get net-30 terms because they don’t have credit established.

- There is another form of invoicing terms that does not particularly extend credit to the client.

- Usually, pay immediately, and net 10 or net 15 is offered to new or late-paying clients.

- This is a type of transaction where the customer has to provide payment when the goods are delivered.

However, there is also a “due date” at the top that clarifies what day payment is due. Any personal views and opinions expressed are author’s alone, and do not necessarily reflect net 30 payment terms the viewpoint of Nav. Editorial content is not those of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities.

Applying for Vendor Accounts

Businesses on the receiving end of your net terms program might be tempted to buy more inventory from their revenue, instead of paying their debts off quickly and avoiding fees. Stores that don’t use sales profits from high turnover items to pay down invoices for slow-moving items will eventually ruin their credit or have to dig into savings. In HLC’s over 35 years in business, it’s found that long payment terms promote poor cash management and, as a result, may be detrimental to many customers. For example, let’s say you purchased inventory with your credit card on February 1st and your billing cycle ends on February 28th.

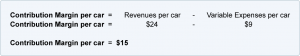

- If the invoice is paid after 10 days and before 30 days, the invoice total is $10,000.

- Just like anything, net 30 payment terms have their pros and cons.

- Small companies with smaller order volumes should generally use shorter invoices terms and larger companies with high value orders can incentivize quicker payments with discounts.

- One important thing to consider is that clients may have differing opinions of what net 30 actually means.

- You’ll find a variety of templates and styles to suit your business.

- On an invoice, net 15 means that full payment is due 15 days after the invoice date, at the very latest.

- The job or service is already completed, but the client hasn’t paid yet.

Recent Comments